suspended large-scale sailings and canceled more than 100 voyages!

In the past two years, ocean freight rates have continued to rise, and sky-high freight rates have been “live for a long time”, which has brought a lot of pressure to foreign trade enterprises. After experiencing unprecedented prosperity, the recent decline in freight rates on major routes has continued to expand, and the container shipping market has become more and more aggressive. …

Freight rates halved for 14 consecutive weeks! The pressure of the shipping company to fill the tank leads to bargain hunting

According to the latest data released by the Shanghai Stock Exchange on September 16, the SCFI index continued to fall by 249.47 points to 2312.65 points last week, continuing to hit the lowest point since December 2020, and the decline slightly converged to 9.73% compared with the previous week. Compared with the historical high of 5109 points at the beginning of the year, the SCFI index has fallen by nearly 55%. It has fallen for 14 consecutive weeks, and has halved since the all-time high at the beginning of the year.

Among the main routes, the US-West Line fell sharply last week. The freight rate per FEU fell by US$434 to US$3,050, a drop of 12.45%, which was 62.42% lower than the high of US$7,900 at the beginning of the year. The freight rate per FEU on the Eastern United States line was US$7,176, a weekly drop of US$591, or 7.6%, and a drop of 40.08% compared with the high point at the beginning of the year.

The European line is also difficult to stop the decline. The freight rate per TEU fell by US$332 to US$3,545 per week, a weekly decline of 8.56%, and a cumulative decline of 54.53% compared with the high point at the beginning of the year. The freight rate per TEU on the Mediterranean Line fell below the $4,000 mark and fell to $3,777, down $445 or 10.54% for the week.

The freight rate of the South America Line (Santos) per TEU fell by US$841 to US$6,342, or 11.71%.

The freight rate of Southeast Asia Line (Singapore) per TEU was US$403, down US$60 or 12.96% for the week.

However, last week, the freight rate of the South Korea line in the near-ocean line rose slightly by USD 12, and the freight rate per TEU increased to USD 265, a weekly increase of 4.74%, which was the only one that increased among all routes.

Industry insiders pointed out that the SCFI index is an average covering spot price and long-term contract price. However, in the spot market, it has already fallen below $3,000, and the spot price per FEU on the European line has also dropped by $5,500 to $6,000. The main routes all fell sharply, showing that the consumer demand in Europe and the United States was weak and sluggish, and the shipping companies were under great pressure to fill the tank, which led to bargaining and rushing for goods.

Rare in history! Shipping companies have suspended large-scale sailings and canceled more than 100 voyages! Cancellation rate 16%

As freight rates continue to fall, container shipping companies have taken measures to control capacity to try to ease the decline in freight rates.

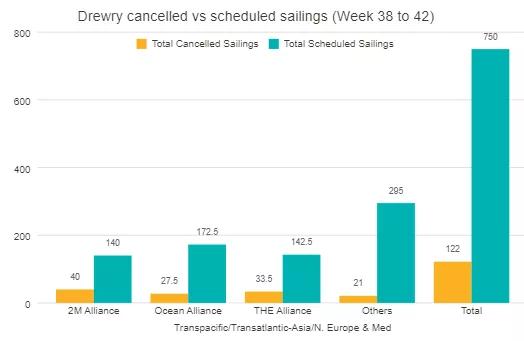

According to the latest data released by Drewry on September 16, in the next five weeks (weeks 38-42), the world’s three major shipping alliances have successively cancelled a total of 101 voyages. 2M has announced 40 cancellations, followed by The Alliance and Ocean Alliance with 33.5 and 27.5 cancellations, respectively.

Of the 750 scheduled sailings on major routes such as Trans-Pacific, Trans-Atlantic and Asia-Nordic and Mediterranean, 122 sailings were declared cancelled between Weeks 38 and 42, a cancellation rate of 16%. During this period, 68% of blank sailings will occur eastbound trans-Pacific, 24% will occur in Asia-Nordic and Mediterranean, and 8% will occur in westbound transatlantic trade.

Drewry said the container shipping market continued to soften, with spot rates from China falling faster than expected month-on-month as weaker container demand, ample inventories, a shift in consumer spending from goods to services and an uncertain economic environment contributed to the at this point. As shipping lines try to adjust capacity to falling freight demand, there has been a surge in air traffic on major east-west trade routes.

As the SCFI index continued to fall, container shipping companies also began to face pressure to renegotiate long-term freight rates. Major container shipping companies including Yang Ming Shipping and Wan Hai Shipping have all confirmed that the effect of the collapse of freight rates has expanded. Customers have begun to ask the shipping companies to discuss the freight rates of long-term contracts. Facing the pressure of price adjustment, they are discussing with customers of long-term contracts one after another. , flexible adjustment for different customers is not excluded.

Jiale CO.,LTD today delivery EXCAVATOR H-links TO Australia.

JALE also supply excavator undercarriage parts. Holland, Bobcat, Caterpillar, Komatsu, Hitachi, Doosan, JCB, Kobelco, Hyundai, Volvo excavator and bulldozer in the future!

Post time: Sep-21-2022